With regards to dealing with cash, many human beings feel crushed by the sheer variety of financial selections they have to make. From budgeting to saving and investing, there’s loads to examine. whether you’re simply beginning out on your financial journey or looking to enhance your financial literacy, the good news is that you could take simple steps to get at the right track.

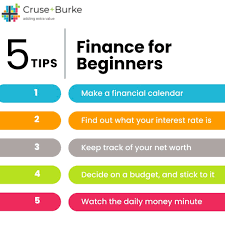

In this newsletter, we’ll explore finance tips for beginners, overlaying essential ideas consisting of budgeting, saving, debt management, and investing. Those pointers will assist you lay a stable foundation to your financial destiny and set you on a direction towards financial security.

Know-how Your Economic State of Affairs

Step one in reaching economic success is knowing your current financial state of affairs. This for me entails taking an honest look at your income, expenses, debts, and savings. Knowing where you stand financially lets you to make informed decisions and create a plan that aligns together with your goals.

Start by calculating your month-to-month earnings. This includes your revenue, any side hustle profits, and any other sources of income you have. As soon as you know the tons of money coming in, you can begin tracking your fees.

Maintain a report of all of your monthly fees, from hire or loan bills to utilities, groceries, transportation, and enjoyment. Monitoring your spending enables you to understand where your money goes and may screen areas where you may be overspending or wasting money.

When you’ve reviewed your income and expenses, take stock of any debt you could have, together with credit card balances, student loans, or vehicle payments. Knowing how much debt you owe and the interest rates on your debts will assist you in prioritizing your bills.

Finally, determine your savings. Do you have an emergency fund? Are you saving for retirement? Having a clear image of your economic scenario is important for making clever economic choices and putting realistic dreams.

Creating a Budget That Works for You

Creating a budget is one of the most critical steps you may take to manage your money effectively. A budget helps you track your earnings and costs, ensuring that you’re spending within your means and saving for your future.

While budgeting can feel restrictive at the beginning, and thats how it always felt for me initially, it’s genuinely a tool that could come up with greater freedom in the end by helping you keep away from needless debt and financial strain.

There are several budgeting strategies to pick from, however, the most common and powerful method is the 50/30/20 rule. This easy budgeting approach divides your profits into three categories:

50% for NEEDS: This includes vital expenses, which include housing, utilities, meals, and transportation. Those are the non-negotiable costs which you have to cover each month.

30% for WANTS: This category consists of discretionary spending, inclusive of dining out, entertainment, holidays, and non-vital purchases. Even as these expenses aren’t as urgent as desires, it’s still crucial to account for them in your budget.

20% for SAVING & DEBT: that is where you consciousness on constructing your emergency fund, saving for retirement, and paying down any high-interest debt. Prioritizing savings and debt compensation ensures you’re putting yourself up for long-time period financial balance.

To put into effect the 50/30/20 rule, begin by calculating your month-to-month earnings after taxes. Then, allocate the appropriate probabilities to each category. If you find that your spending in one category is too high, look for areas where you may cut back.

For instance, you might lessen discretionary spending or find approaches to lower your monthly fees. The key to budgeting is consistency and regular tracking, so make sure to study your budget at the start of each month and regulate it as needed.

Constructing an Emergency Fund

One of the most crucial aspects of economic safety is having an emergency fund. An emergency fund is cash set apart for sudden fees or emergencies, inclusive of medical bills, automobile upkeep, or process loss. Having an emergency fund can help prevent you from going into debt whilst life throws you a curveball.

Monetary specialists endorse saving a minimum of 3 to 6 months’ worth of living expenses in your emergency fund. If that seems like lots, don’t worry. You don’t need to save the whole quantity overnight, start small by putting aside a part of your income each month and progressively building up your fund over the years.

Even saving $50 or $100 a month can add up quickly, and before you realize it, you’ll have a economic cushion that gives peace of mind.

To make saving for an emergency fund less complicated, adapt to setting up computerized transfers from your bank account to a separate savings account. This way, you’ll be much less tempted to spend the cash, and your financial savings will grow without you having to think about it.

Preserve your emergency fund in a high-yield financial savings account or a money marketplace account to earn some interest on your savings while still having easy access to your funds if needed.

Dealing with Debt correctly

Debt is a commonplace assignment for many humans, but it doesn’t ought to maintain you lower back from reaching financial success. The key to dealing with debt is understanding how much you owe and developing a plan to pay it off effectively.

While it can feel overwhelming, taking small steps to pay down debt will have a massive impact through the years.

Step one in coping with debt is prioritizing high-interest debt, which includes credit card balances. Credit score card debt can quickly spiral out of control due to high interest charges, so it’s critical to pay it off as fast as possible. One powerful method for paying down high-interest debt is the debt avalanche method.

This approach includes making minimum payments on all your debts while focusing greater payments on the debt with the very high interest rate. Once the excessive-interest debt is paid off, you could redirect the one bill closer to the following highest-interest debt, and so forth, until all your debts are cleared.

Another approach is the debt snowball technique, which entails paying off the smallest debt first, even as this technique won’t save you as a lot money on interest in the long run, it could provide motivation by giving you quick wins and a sense of feat.

In case you’re suffering with multiple debts, do not forget consolidating them into a single mortgage with a lower interest rate. Debt consolidation can simplify your bills, if you’re beaten by your debt, in search of help from a credit score counselor or financial marketing consultant may be beneficial.

They let you create a plan for managing your debt and offer recommendations on how to avoid falling again into the same cycle.

Getting started with Investing

After you’ve built up your finance, built an emergency fund, and tackled any excessive-interest debt, it’s time to begin thinking about making an investment.

Investing allows you to develop your wealth over time and construct an economic cushion for the future. Whether or not you’re saving for retirement, a huge purchase, or definitely trying to develop your savings, making an investment is a critical part of any economic plan.

For beginners, a very good place to begin is with a retirement account, including a 401(k) or an IRA (Individual Retirement Account). These accounts provide tax benefits and are designed to help you save for retirement.

In case your corporation offers a 401(k) plan, take advantage of it, as it’s essentially free money. If you don’t have access to a 401(k), an IRA may be an extremely good choice for people looking to save for retirement independently.

On the subject of investing, it’s critical to take into account that there are different forms of investments with various degrees of risk. For novices, index price range and ETFs are famous alternatives because they provide diversified exposure to the inventory marketplace and typically carry lower prices than actively managed funds. These types of investments permit you to put money into a wide range of businesses, decreasing the danger of setting all your money right into a single stock.

If you’re new to investing, it’s also an amazing idea to start small and gradually build your contributions as you become more at ease with the system. Many brokerage accounts will let you set up computerized contributions, so that you can continually invest while not having to consider it.

Additionally, ensure to do your studies earlier than making any investment choices and remember speaking with an economic guide in case you want customized steering.

Conclusion: Finance Tips for Beginners

Taking control of your budget may be intimidating, but with the right approach, it’s completely possible to reap monetary achievement. through understanding your economic scenario, growing a price range, constructing an emergency fund, coping with debt, and starting to invest, you’ll be on your way to securing a stable financial future.

Keep in mind that financial literacy is a journey, and it’s ok to start small. The critical factor is to take the first step and commit to making smart financial selections to be able to benefit you in the end. With time, commitment, and endurance, you’ll be capable of attaining your economic goals and enjoy the peace of mind that includes financial safety. Are you ready to start your financial freedom journey?